Texas drivers can access quick and flexible cash solutions through Car Title Loans in Texas, offering same-day funding, adaptable repayment plans, and minimal requirements. These loans leverage vehicle equity, appealing to those with less-than-perfect credit or urgent needs. With competitive interest rates, transparent terms, and a streamlined online application, Car title loans Texas provide a reliable alternative financing option for various financial circumstances.

In the vibrant, bustling landscape of Texas, car title loans have emerged as a popular solution for drivers in need of quick cash. These flexible loan options allow Texans to access substantial funds using their vehicles as collateral, providing an efficient and straightforward process. With lower interest rates compared to traditional loans, car title loans Texas offer a financially beneficial alternative. This secure lending method caters to various borrower needs, ensuring swift access to much-needed capital for Texas drivers.

- Flexible Loan Options for Texas Drivers

- Quick Access to Cash Using Your Vehicle

- Lower Interest Rates: A Financial Benefit

Flexible Loan Options for Texas Drivers

Texas drivers often find themselves in situations where they need quick access to cash, and Car Title Loans in Texas offer a flexible solution. These loans are designed with the unique needs of Texas residents in mind, providing an alternative to traditional banking options. One of the key advantages is the variety of repayment plans available, catering to different driver profiles and financial circumstances.

Whether it’s a need for quick funding due to an unexpected expense or a desire for more manageable monthly payments, secured loans like Car Title Loans Texas offer a range of structures. Some lenders even provide same-day funding, ensuring that drivers can receive their funds promptly when they need them most. This accessibility and adaptability make car title loans an attractive option for those looking to bridge financial gaps without the stringent requirements often associated with traditional loans.

Quick Access to Cash Using Your Vehicle

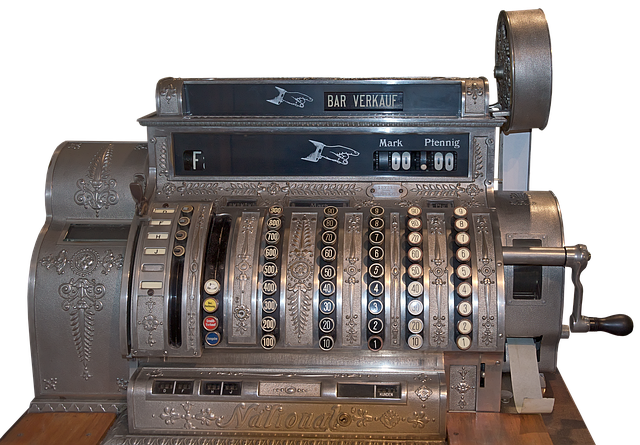

In the competitive market of Texas, Car Title Loans have emerged as a preferred choice for many drivers seeking quick financial relief. The appeal lies in the loan’s unique structure, which allows individuals to leverage their vehicle’s equity. This innovative approach ensures that drivers can access substantial cash amounts with minimal hassle and fast processing times. By utilizing your car as collateral, you bypass the traditional credit check process often associated with bank loans, making Car Title Loans an attractive option for those with less-than-perfect credit or limited financial history.

This alternative financing method is particularly appealing during unforeseen circumstances, such as unexpected repairs or urgent expenses. With an Online Application process, drivers can initiate the loan request from the comfort of their homes, saving time and effort. The entire transaction is streamlined, offering a quick solution to short-term financial needs without the usual delays. Whether it’s for an emergency or a planned purchase, Car Title Loans in Texas provide a convenient and accessible way to get cash using your vehicle as security.

Lower Interest Rates: A Financial Benefit

Car title loans Texas offer a financial advantage that sets them apart from traditional loan options. One of the key benefits is the significantly lower interest rates. Unlike cash advance services or Fort Worth loans, which often come with high-interest rates and hidden fees, car title loans have more competitive pricing. This is largely due to the fact that these loans are secured by a driver’s vehicle. The lender has less risk, allowing them to offer better terms.

When taking out a Car title loan Texas, drivers can expect transparent lending practices with clear interest calculations. During the application process, a thorough vehicle inspection may be conducted to assess its value. However, this inspection doesn’t impact the overall cost as it’s merely for security purposes. This ensures that borrowers understand exactly what they’re agreeing to, promoting financial peace of mind.

Car title loans in Texas offer a unique and appealing solution for drivers seeking flexible financing options. By utilizing their vehicle as collateral, Texans can access quick cash with lower interest rates compared to traditional loan alternatives. This convenient method provides a straightforward path to financial relief, making car title loans an attractive choice for those in need of immediate funding.